If you’re looking for an investment strategy that focuses on long-term financial growth with a lower risk profile, coffee can investing may be worth exploring. This investment approach takes a long-term buy-and-hold perspective on investing in high-quality stocks. By investing in companies you believe in and leaving your money alone for an extended period, the goal of coffee can investing is letting time and dividends do the work for you.

- What is Coffee Can Investing?

- The Performance of Coffee Can Portfolios: Stocks, Dividends, and Wealth Creation

- Reducing Costs and Risks in Coffee Can Investing

- How to Start a Coffee Can Investment Portfolio: Research to Execution

- Incorporating Commodities and Assets

- Time as a Factor in Coffee Can Investing

- Investment Strategy for Trading, Performance, Monitoring

- Rebalancing and Options in Coffee Can Investing

- Conclusion: Staying Committed to Your Investment Goals

- Frequently Asked Questions

Coffee can investing appeals to those seeking a straightforward, cost-effective way to build wealth by owning shares in successful businesses over many years. This approach avoids obsessing over short-term price fluctuations or constantly chasing the latest market trends. While there are many different investment strategies, this strategy allows the power of compound returns to work in your favor through steady dividend reinvestment and capital appreciation. While some more actively traded portfolios or funds may outperform in certain periods, coffee can investing takes a passive approach to investing and has proven itself as a reliable wealth generator over time.

What is Coffee Can Investing?

A Coffee Can Investment Portfolio is a long-term investment strategy inspired by an anecdote from financial advisor Robert Kirby. The term originates from the practice of storing valuable stock certificates in a coffee can for safekeeping. In this strategy, an investor selects a diversified range of high-quality stocks and holds them for an extended period, typically five to ten years or even longer, without actively buying or selling them.

Kirby would research companies with good management, strong cash flows, sustainable competitive advantages and potential for long-term growth. After he identified securities or stocks that met all his criteria, he would purchase shares directly from the firm and place the paper certificates in his portfolio “coffee cans.” Documenting just the basic purchase dates and prices, Kirby then largely forgot about the coffee cans. He instead focused on his job as a stockbroker and let compounding work its magic. Decades later when he reviewed the cans, many holdings had grown enormously based on steady business performance.

For intermediate traders like Kirby, the strategy was about letting compound interest do its work. It’s an ideal approach if you’re just getting started investing.

The Performance of Coffee Can Portfolios: Stocks, Dividends, and Wealth Creation

Many studies examining actual coffee can portfolios of various individual investors have found they significantly outperformed even top-performing traders with an actively managed approach, particularly over periods of 15+ years. There are several key reasons why they deliver favorable results.

Firstly, by allowing investments to compound over an extended period, Coffee Can portfolios can harness the power of time and exponential growth. Successful stocks have the opportunity to generate significant returns, outweighing any underperforming positions. The compounding effect can amplify the overall performance of the portfolio, leading to long-term wealth creation.

Secondly, Coffee Can portfolios help reduce transaction costs. Since they require minimal trading activity, investors can avoid frequent buying and selling, which helps reduce transaction costs, including brokerage fees and taxes. By minimizing these costs, investors can retain a larger portion of their investment returns, enhancing their overall profitability.

Lastly, the Coffee Can approach eliminates emotional bias from the investment decision-making process. Emotional decision-making often leads to poor investment choices. However, with a Coffee Can strategy, you are encouraged to stay committed to your initial stock selection. The temptation to make impulsive decisions based on short-term market fluctuations is reduced. This disciplined approach helps you avoid common behavioral biases that can negatively impact investment performance. It allows you to stay focused on the long-term potential of your chosen stocks.

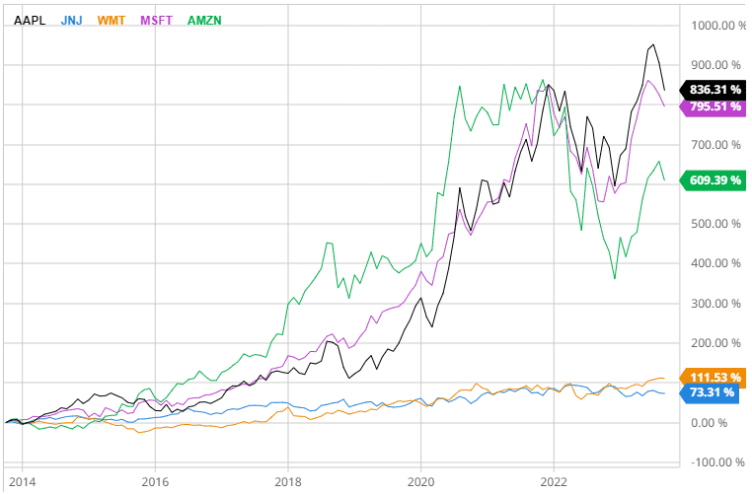

The graph below demonstrates the growth of 5 popular stocks if they were purchased 10 years ago, and left to grow.

Reducing Costs and Risks in Coffee Can Investing

One key advantage of the coffee can approach is lowering investment costs. By minimizing trading, you avoid brokerage fees with each transaction. Back in the 1980s, a single trade could cost $150 or more through full-service brokers, wiping out small gains. Trading also incurs taxes on capital gains that buy-and-hold avoids. You also face less risk by not reacting to short-term market fluctuations which can lead you to sell low and buy high.

Focusing on companies with steady cash flows insulates your portfolio from broader risks in the real estate and commodities markets in the long run. Dividend growth stocks, which some considered to be ‘dividend kings’, tend to increase payouts even when the economy stumbles, providing reliable income. The buy-and-hold mindset also helps ensure your investments align with your long-term savings goals rather than trying to time unpredictable swings. Sitting through downturns conditions you not to panic and bail out at the worst times psychologically.

How to Start a Coffee Can Investment Portfolio: Research to Execution

The process starts with extensive fundamental analysis and research on prospective companies. Sources like annual reports, Morningstar profiles, and stock screeners can help narrow options of stocks that meet your criteria. Carefully consider a company’s management competence, competitive advantages, margins/returns on capital, and growth opportunities. Forecasts should indicate the potential for long-term gains well above inflation. Consider companies resolving environmental, social, and corporate governance risks (ESG risks) proactively too to ensure sustainable earnings.

Consider spreading your stock selection across sectors and industries rather than over-concentrating individual risk. Instead of putting all your money in stocks from just one industry or sector, try to mix it up. This way, you’re not putting all your eggs in one basket. Also, don’t just stick to your own country’s market. Investing in different countries can help lower your risks because markets around the world don’t always move in the same direction.

Choose only your highest rated picks to invest a set amount each month or quarter for dollar cost averaging rather than investing all of your cash at once. Start with 5-10 quality companies to allow compounding time. Review your holdings periodically, but generally hold your stocks even when the market is volatile, without letting your emotions drive your buy and hold decisions.

Incorporating Commodities and Assets

While the traditional coffee can model focuses only on dividend-paying individual stocks, some expand the approach to include additional asset classes like commodities, assets like real estate, and exchange-traded funds for additional diversification. Precious metals can also provide a small hedge against inflation. That is to say, when inflation increases, the value of precious metals and commodities usually also increases.

Investing in publicly traded commodities firms like crop, livestock, or metals producers brings industry-level exposure without needing to understand ongoing futures pricing dynamics. Real estate investment trusts trade similar to stocks while tapping into property income streams. Their history of dividend payouts also indicates they tend to withstand recessions better than other sectors.

Including index-aligned exchange traded funds in your coffee can portfolio allows you to tap into indexes that would be too costly to replicate individually. ETFs covering sectors, regions, factors, or alternative assets help keep your portfolio diversified with many different stocks. In moderation, these types of investments complement traditional stock holdings. Also, ETFs will periodically rebalance their stock allocations within the fund without you needing to take an active role.

Time as a Factor in Coffee Can Investing

Given almost any portfolio will experience periodic downturns, one major advantage of the coffee can investing approach is its long time horizon. Many studies show leaving funds untouched even in just a simple portfolio outpaces returns from actively picked stocks or funds that are traded frequently. This can be due to lower costs and taxes which are avoided from realizing short-term capital gains/losses.

While remaining fully invested allows capturing upswings, the frequency and depth of crashes can take an emotional toll which can drive “buy high, sell low” decisions. Filtering out short-window noise and committing to long periods, like decades, before assessing performance, allows compound interest to work marvels. Modern portfolio theory research indicates a majority of returns depend on systematic market exposure, not attempting to time volatile fluctuations nearly impossible to predict. With coffee can investing, ‘time in the market’ matters most, rather than ‘timing the market’.

Investment Strategy for Trading, Performance, Monitoring

Rather than seeking short-term trades, focus on sustainable wealth growth emphasizing quality over fluctuations. Set portfolio guidelines like minimum market caps, credit ratings, and dividend/profitability thresholds for additions. Systematically reinvest your distributions and only rebalance broadly when weightings shift beyond set limits.

Review your portfolio’s performance annually by checking financial statements and researching disruption risks rather than fixating on short-term price swings. Replace any holdings that have significantly deteriorated in quality with new opportunities identified through a continual research process. Outsource monitoring through screened dividend ETFs once your portfolio reaches sufficient size and diversification, reassessing periodically.

Rebalancing and Options in Coffee Can Investing

Revisit portfolio allocations periodically like every 12 months to rebalance back to original target weights. When some of your stocks are doing really well, consider selling them to lock in the profits. Then, use that money to buy more shares of companies that aren’t doing so well right now but have solid potential for the long term. This way, you’re selling high and buying low, which is a classic investment strategy.

Over time, even small wins can add up in a big way because of compound growth. For instance, if you can beat the S&P 500’s average yearly return of 10% by just 1%, your investment will double in 22 years. If you just matched the S&P 500, it would take 33 years to do the same. So, every little gain counts.

Covered calls are a way to make extra money from stocks you already own. Here’s how it works: you agree to possibly sell some of your stocks at a certain price in the future, and in return, you get paid a fee upfront. This fee is what we call “premium income.” Even if you have to sell the stocks later, you still make some money and protect yourself from losses.

But what if you’re not familiar with how options work? Don’t worry; there’s an easier way to do this. You can invest in something called a long-term buy-write ETF. This is like a bundle of stocks that automatically uses the covered call strategy for you. So, you get that extra income without needing to be an expert in options.

Conclusion: Staying Committed to Your Investment Goals

While coffee can investing relies on compound interest rather than promises of windfall returns, its simple, low-cost approach has stood the test of decades. Success comes down to committing to the long haul by developing appropriate criteria, ignoring short-term noise, and systematically executing your well-researched plan over many years. Overall, coffee can investing exemplifies letting the markets work for you rather than constantly working to outguess inevitable near-term fluctuations. With discipline and patience, time likely favors those who stay the course.

Frequently Asked Questions