Exchange Traded Funds (ETFs) have taken off as an investment vehicle over the past few years, revolutionizing the way investors approach the financial markets. In this guide, we’ll take a look at their features, benefits, and the various types available. Understanding these aspects will prepare you to make informed investment decisions and maximize your portfolio’s potential.

What is an ETF?

An ETF, or Exchange Traded Fund, is a type of investment fund that is traded on stock exchanges, similar to individual stocks. It is designed to track the performance of a specific index, sector, commodity, or asset class. ETFs are created by financial institutions, which gather a basket of stocks or other assets that mirror the composition of a stock index or investment strategy.

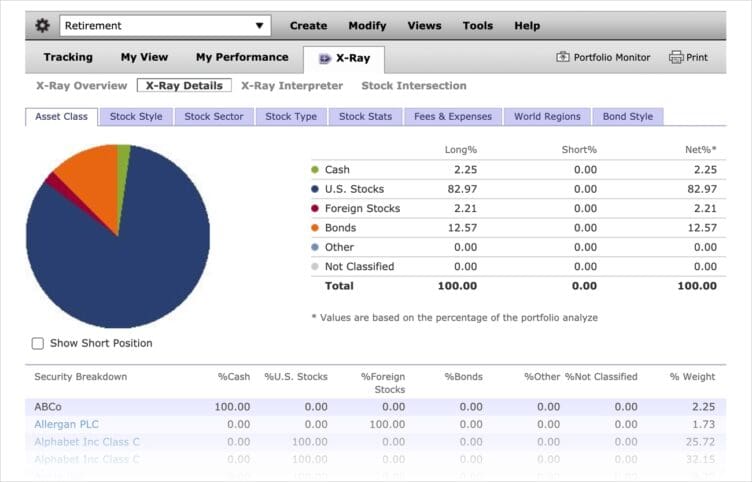

When you invest in an ETF, you are essentially buying shares that represent ownership in the fund. The price of an ETF share is determined by the value of the underlying assets it holds. ETFs can provide you with exposure to a wide range of markets and investment strategies, such as stocks, bonds, commodities, or real estate, depending on the specific ETF.

One of the key advantages of ETFs is their ability to offer diversification. By investing in an ETF, you gain exposure to a basket of securities, which helps spread the risk across different assets. ETFs also provide liquidity, as they can be bought and sold throughout the trading day on stock exchanges, unlike traditional mutual funds that are priced at the end of the trading day.

ETFs generally have lower expense ratios compared to actively managed mutual funds, making them a cost-effective investment. They also offer transparency, as their holdings are typically disclosed on a daily basis, allowing you to know exactly what assets the ETF owns.

Investing in ETFs carries some risks, including market volatility, potential tracking error (the ETF not precisely matching the performance of the underlying index), and the possibility of the underlying assets declining in value. It’s always recommended to conduct thorough research and consider your investment goals and risk tolerance before investing in any financial product, including ETFs.

Types of Exchange Traded Funds

Passive ETFs

Passive or Index Exchange Traded Funds are designed to replicate the performance of a specific index, such as the S&P 500. These funds provide broad market exposure, allowing you to track the performance of the overall market. On the other hand, active ETFs employ portfolio managers who actively make investment decisions, deviating from strict index replication. While active management may offer potential benefits, it is important to note that these funds may have higher costs associated with them.

Here are a few examples of passive ETFs:

These examples represent just a few of the many passive ETFs available in the market. Each ETF aims to track a specific index or benchmark, providing you with an easy and cost-effective way to gain exposure to different segments of the market.

Bond ETFs

Bond ETFs are specifically designed to provide regular income. These funds invest in a variety of bonds, including government, corporate, and municipal bonds. Unlike individual bonds, bond ETFs do not have a fixed maturity date. Instead, they trade at a premium or discount to their underlying bond prices, providing an opportunity to generate income while maintaining liquidity.

Here are three of the more popular bond ETFs:

Industry or sector ETFs

Industry or sector ETFs focus on a specific sector or industry. By investing in companies operating within a particular sector, you’re able to gain exposure to the upside potential of that industry. For example, technology sector ETFs have witnessed significant inflows in recent years, allowing you to participate in the growth of the tech industry. Moreover, industry ETFs can be used to implement sector rotation strategies, so that you can capitalize on economic cycles.

For a novice investor, the following industry ETFs are a good place to start investing:

Commodity ETFs

Commodity ETFs offer exposure to commodities such as crude oil or gold. Investing in these funds provides diversification benefits and potential protection against market downturns. Commodity ETFs are a cost-effective alternative to physically owning commodities, as they eliminate the need for insurance and storage costs.

Here are three examples of commodity ETFs:

Currency ETFs

Currency ETFs track currency pairs and can be used for speculation, diversification, or hedging purposes. These funds provide exposure to different currencies without directly participating in the foreign exchange market. Currency ETFs are particularly useful for those looking to hedge against currency volatility or capitalize on political and economic developments in specific countries.

Here are three examples of currency ETFs:

Inverse ETFs

Inverse ETFs offer a unique investment strategy, seeking to profit from declining stock prices. These funds utilize derivatives to short stocks, essentially betting against the market. Inverse ETFs can serve as a hedge during market downturns, allowing you to capitalize on bearish market expectations.

Here are three examples of inverse ETFs:

Leveraged ETFs

Leveraged ETFs provide the opportunity to amplify returns by seeking multiple times the return of the underlying investments. For instance, a 2x leveraged S&P 500 ETF aims to deliver double the daily return of the S&P 500 index. However, it is important to note that leveraged ETFs employ derivatives, such as options or futures contracts, to achieve their desired leverage. As a result, these funds tend to be more complex and carry higher risks compared to traditional ETFs.

Here are three examples of leveraged ETFs:

Leveraged ETFs can offer the potential for enhanced returns for short-term trading or tactical investment strategies. However, keep in mind that leverage works in both directions, magnifying losses as well as gains. Due to the compounding effect, leveraged ETFs are typically designed for short-term trading and may not be suitable for long-term investment horizons. If you’re considering leveraged ETFs you should carefully assess your risk tolerance, understand the unique characteristics of these funds, and consider seeking professional advice before investing.

Benefits of Exchange Traded Funds

It’s important to understand not only the risks but also the benefits associated with ETFs. One of the key benefits of ETFs is their cost-effectiveness. ETFs typically have lower expense ratios compared to mutual funds, and buying and selling ETFs on the stock exchange incurs fewer broker commissions compared to purchasing individual stocks.

Liquidity is another advantage of ETFs. Due to their exchange-traded nature, ETFs can be easily bought and sold throughout the trading day at market prices. This provides flexibility and the ability to adjust your positions based on changing market conditions. Moreover, the liquidity of ETFs can contribute to tighter bid-ask spreads, reducing your transaction costs.

ETFs also offer transparency, as the underlying holdings of the fund are disclosed on a daily basis. This transparency enables you to have a clear understanding of what assets you are investing in and how the fund is performing. It also allows for better portfolio management and monitoring.

In terms of taxation, ETFs generally have tax advantages compared to mutual funds. Due to their unique structure, ETFs are more tax-efficient, as they have the ability to minimize capital gains distributions. This can result in potential tax savings.

Wrapping Up

As the popularity of ETFs has grown, the number of available options has expanded significantly. Today, you’re able to choose from a wide array of ETFs that cater to various investment strategies and objectives. Whether you are looking for broad market exposure, sector-specific investments, or niche asset classes, there is likely an ETF available to suit your needs.

It is important to conduct thorough research and due diligence before investing in ETFs. Factors to consider include the fund’s expense ratio, tracking error (the deviation of the ETF’s performance from the underlying index), the fund’s liquidity and trading volume, and the reputation and track record of the fund issuer.

ETFs have revolutionized the investment landscape by offering a flexible, cost-effective, and diversified approach to accessing the financial markets. With their ability to track various indices, sectors, commodities, and investment strategies, ETFs have gained significant popularity among both individual and institutional investors. By understanding the different types of ETFs and their unique characteristics, you’re able to make informed decisions and incorporate these powerful investment tools into your portfolio. As always, you should consult with a financial advisor to ensure that ETFs align with your investment goals and risk tolerance.

Next: Guide to Buying ETFs