The process of building a stock portfolio requires a good understanding of stock fundamentals and fundamental analysis. These fundamentals serve as indicators of a company’s financial health and provide you with the necessary information to make informed decisions about which stocks to include in your portfolio.

What is Fundamental Analysis?

Fundamental analysis is the method by which a stock’s qualitative and quantitative fundamentals are examined. Quantitative stock fundamentals refer to the financial data associated with a company. These data points are derived from a company’s financial statements, which include the income statement, balance sheet, and cash flow statement. By analyzing quantitative stock fundamentals, investors can assess a company’s profitability, debt levels, and operational efficiency, among other financial aspects.

By undertaking fundamental analysis you can assess a security’s intrinsic value (its ‘true’ value) by examining related economic and financial factors. Intrinsic value refers to the value of an investment based on the company’s financial situation and current market and economic conditions. Fundamental analysts study anything that can affect the security’s value, from macroeconomic factors such as the state of the economy and industry conditions to microeconomic factors like the effectiveness of the company’s management.

The objective of fundamental analysis is to come up with a number that an investor can compare with a security’s current price to see whether the security is undervalued or overvalued. This is achieved by conducting a thorough analysis from a macro to micro perspective to identify securities that may be overvalued or more importantly, undervalued.

Fundamental analysis is the cornerstone of any long-term investment portfolio.

Key Stock Fundamentals

There are many key quantitative stock fundamentals that investors typically consider when analyzing a company’s financial health. Here are some of the basic fundamentals:

How to Analyze Stock Fundamentals

The analysis of stock fundamentals involves the interpretation of these and many other financial metrics. When analyzing these fundamentals, a company’s metrics are compared with those of other companies within the same industry. This allows for a more accurate assessment of a company’s relative financial health and performance.

Thankfully, as a new investor you don’t have to undertake your own fundamental analysis of stocks. You could calculate a company’s quantitative fundamentals using publicly available information released in quarterly or annual statements and reports. But most of the time fundamental analysis can be found simply by Googling a company’s name followed by the metric in question such as “Microsoft P/E ratio”.

While quantitative stock fundamentals provide valuable insights into a company’s financial health, they are not the sole basis for investment decisions. Other qualitative factors such as the company’s business model, competitive position, and the overall health of the economy should also be considered.

Using Fundamental Analysis and Analyst Ratings to Choose Stocks for Your Portfolio

Stock fundamentals provide valuable insights into a company’s financial health and can be instrumental in assessing a stock’s potential risk and return. For instance, a company with strong earnings growth and a low debt-to-equity ratio may be seen as a lower risk investment with good return potential. Conversely, a company with declining earnings and high debt levels may be seen as a higher risk investment.

Many financial analysts have already undertaken fundamental analysis on most stocks, and you can get an understanding of the analyst ratings of a stock by googling, for example, “Microsoft analyst rating”. Analyst ratings are assessments given by financial analysts about the potential performance of a particular stock or security. These ratings are typically issued by investment banks or other financial research firms, and they are used to provide investment advice to the public, their clients, or their firm’s clients.

Analyst ratings usually come in the form of “buy,” “sell,” or “hold” recommendations. Here’s what each rating generally means:

In addition to these three, some analysts use ratings like “outperform” (expecting the stock to do slightly better than market averages), “underperform” (expecting the stock to do slightly worse), or “strong buy” and “strong sell” to indicate a particularly bullish or bearish outlook.

It’s important to note that analyst ratings are based on the analyst’s research and opinion, and they are not guarantees of a stock’s future performance. Different analysts may also have different opinions on the same stock. Therefore, while analyst ratings can be a useful tool for investors, you should review a range of ratings from more than one analyst, and they should be used as part of a broader investment research strategy.

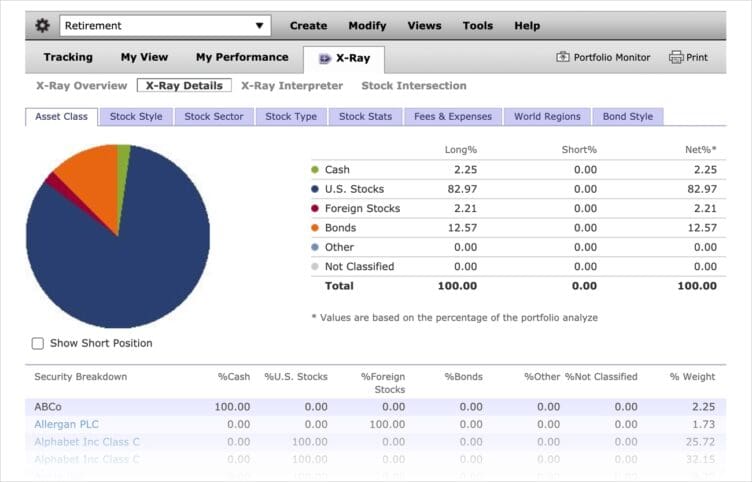

Diversification is a key strategy in portfolio management, and understanding stock fundamentals can aid in achieving a diversified portfolio. By analyzing the fundamentals and analyst ratings of different companies across various sectors, you can select a mix of stocks that helps to spread risk and potentially enhance returns.

Case Study: Microsoft (MSFT)

Let’s conduct a basic analysis of Microsoft Corporation (MSFT) using five core fundamentals:

Based on these stock fundamentals, Microsoft appears to be a financially healthy company with strong profitability, efficient use of assets, conservative financial leverage, and significant reinvestment in its business. These are just a few of the many financial metrics you can use to evaluate a company’s financial health and investment potential.

Limitations of Stock Fundamentals

While stock fundamentals are a vital part of investment analysis, they are not the only factors to consider when choosing stocks for your portfolio. Qualitative factors such as a company’s strategy, industry trends, and macroeconomic factors also play a significant role in its potential for success.

For instance, a company may have strong quantitative fundamentals, but if it operates in a declining industry or faces significant regulatory challenges, its future performance could be at risk. Similarly, macroeconomic factors such as economic growth rates, inflation, and interest rates can impact a company’s profitability and stock performance.

Other Tools for Stock Analysis

In addition to fundamental analysis, other tools such as technical analysis and qualitative analysis can provide valuable insights. Technical analysis involves studying price patterns and trends to predict future price movements. It can complement fundamental analysis by providing insights into market sentiment and potential turning points in stock prices.

Qualitative analysis, on the other hand, focuses on non-quantifiable factors such as the quality of a company’s management team, its competitive position, and the strength of its brand. These factors can have a significant impact on a company’s long-term success and can provide important context to the numbers revealed in fundamental analysis.

While stock fundamentals are a crucial part of the investment decision-making process, they should be used in conjunction with other tools and considerations to build a well-rounded view of a company’s potential for success.

Frequently Asked Questions