Whether you’re aiming to build a nest egg for retirement, save for a dream home, or build a college fund, the stock market can help you achieve financial wealth and independence. However, if you’re a beginner, there is a lot to learn before you start to invest in the stock market.

Investing Basics

Before you start buying shares in Apple or Amazon there are some fundamental concepts and terms to understand.

Stocks and Bonds: Stocks represent ownership in a company. When you buy a stock, you’re purchasing a piece of the company and its future earnings. For example, if you buy a share of Tesla, you own a small fraction of Tesla and stand to profit from its success. Bonds, on the other hand, are loans made by investors to a company or government. When you purchase a bond, you’re lending money with the expectation it will be paid back with interest.

Public and Private Companies: Public companies, like Microsoft or Coca-Cola, have shares that are traded on public exchanges. This means anyone can buy a share and become a part-owner. Private companies, like SpaceX, do not have publicly traded shares, and their ownership is typically more closely held.

Stock Exchanges: Stock exchanges are marketplaces where stocks are bought and sold. The New York Stock Exchange (NYSE) and NASDAQ are the two largest in the US, hosting the stocks of thousands of companies, from tech giants like Google to emerging biotech firms.

Supply and Demand: The price of a stock is determined by supply and demand. When a company lists on a stock exchange, it issues a finite number of shares that can be bought and sold. If more people want to buy a stock (demand) than sell it (supply), then the price moves up. Conversely, if more people want to sell a stock than buy it, there would be greater supply than demand, and the price would fall.

Getting Started with Investing

Now that you’re familiar with the basics, let’s review the basic steps to get started.

Set Your Financial Goals: Before you start investing, it’s important to know why you’re investing. Are you saving for retirement, a down payment on a house, or your kid’s college education? Perhaps you’re aiming for financial independence or looking to start a business. Your goals will influence your investment strategy, including what kinds of stocks you should consider and how long you plan to invest. For instance, if you’re saving for retirement 30 years away, you might be able to tolerate more risk and invest in growth-oriented stocks like Tesla or Netflix. If you’re saving for a down payment on a house in five years, you might prefer safer, income-oriented stocks like utility companies or consumer staples.

Understand Your Risk Tolerance: All investments come with some level of risk. It’s important to understand your personal risk tolerance – how much risk you’re comfortable taking on. This will help guide your investment decisions. For example, if you have a low risk tolerance, you might want to invest in established, blue-chip companies like Johnson & Johnson or Procter & Gamble. If you have a high risk tolerance, you might be comfortable investing in smaller, more volatile tech companies.

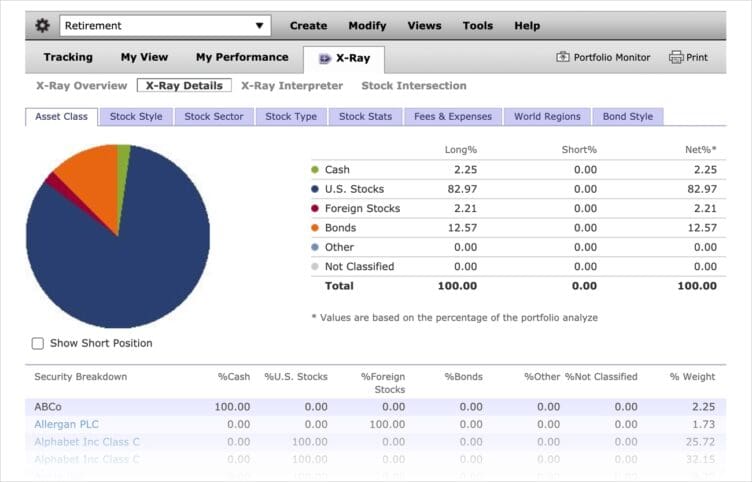

Open a Brokerage Account: To buy stocks, you’ll need to open a brokerage account. There are many types of brokers, including full-service brokers, discount brokers, and robo-advisors. There are also specific types of brokerage accounts for minors. Full-service brokers like Morgan Stanley or Merrill Lynch offer a wide range of services, including financial advice and retirement planning, but they come with higher fees. Discount brokers like Charles Schwab or TD Ameritrade offer fewer services but lower fees. Robo-advisors like Betterment or Wealthfront use algorithms to manage your investments and are a good option for those who want a hands-off approach. It’s a good idea to take a look at the portfolio accounting systems and tools offered by each broker before choosing your broker.

How to Choose Stocks

Choosing the right stocks is obviously an important part of your investment journey. Here’s how to go about it:

Fundamental Analysis: This involves evaluating a company’s financial health, industry position, and market trends. You’ll look at factors like earnings, revenue, and debt levels. For example, a company like Apple, with strong earnings and a dominant market position, might be a good stock to buy based it’s fundamentals.

Technical Analysis: This involves studying statistical trends gathered from trading activity, such as price movement and volume. Unlike fundamental analysis, which looks at a company’s intrinsic value, technical analysis focuses on charts, patterns, and trends in a stock’s price movement. For example, the Relative Strength Index (RSI) measures the speed and change of a stock’s price movements. It helps identify overbought and oversold conditions in the market, which could indicate a good time to buy or sell a stock.

Diversification: This is a risk management strategy that mixes a wide variety of investments within a portfolio. The rationale being that a portfolio constructed of different kinds of investments will, on average, yield higher returns and pose a lower risk. For instance, instead of investing all your money in tech stocks like Facebook and Amazon, you might diversify by also investing in different sectors like healthcare (Johnson & Johnson) or consumer goods (Procter & Gamble). This is because consumer markets usually remain strong when tech markets crash.

ETFs and Index Funds: Exchange-Traded Funds (ETFs) and Index Funds are types of investment funds and products that aim to track the performance of a specific index. They offer diversification and are generally more cost-effective than buying individual stocks. For example, the SPDR S&P 500 ETF (SPY) tracks the S&P 500 index, which includes 500 of the largest companies in the U.S.

Making Your First Trade

Once you’ve done your research and selected the stocks you’re interested in, the next step is to execute your first trade. This process involves placing an order through your broker, who then carries out the transaction on your behalf. Here’s a more detailed look at how this works:

Placing a Trade: Placing a trade involves specifying the type of order you want to execute. There are several types of orders, but the most common are market orders and limit orders.

A market order is an order to buy or sell a stock immediately at the best available current price. It doesn’t guarantee a specific price, but it does guarantee that the order will be filled. This type of order is typically used when the priority is to execute the trade quickly rather than to get a specific price.

A limit order, on the other hand, is an order to buy or sell a stock at a specific price or better. This type of order allows you to set a maximum purchase price for your buy order, or a minimum sale price for your sell order. If the market doesn’t reach these prices, the order won’t be executed. This type of order is used when the priority is to achieve a certain price rather than to execute the trade quickly. You may want to consider placing a limit order when the market is highly volatile. This could be during periods of significant news announcements like earnings releases, economic reports, or geopolitical events where stock prices can experience rapid fluctuations.

The Role of the Broker: A lot of people trade these days with an online broker. Your broker plays a crucial role in executing your trades. When you place an order, your broker sends it to the stock exchange. The exchange then matches your order with a corresponding sell or buy order from another party.

Brokers have access to various exchanges and can often get you a better price than you could get on your own. They also provide a secure platform for trading and offer tools and resources to help you make informed decisions.

Trading Fees: Most brokers charge fees for their services. These fees can vary widely depending on the type of broker you use.

Full-service brokers such as Merrill Lynch offer a wide range of services including investment advice, research, and retirement planning, and they typically charge higher fees for their comprehensive services.

Discount brokers like TD Ameritrade, on the other hand, offer fewer services but charge lower fees. They are a good choice for investors who prefer to make their own investment decisions.

Some brokers, such as Robinhood or E*TRADE, offer commission-free trades. This means they don’t charge a fee for executing trades. However, you should read the fine print, as there may be other costs associated with your account such as regulatory fees imposed by the SEC and FINRA and wire transfer fees when depositing money into your account.

While lower fees can save you money, they shouldn’t be the only factor in choosing a broker. Consider the range of services, the platform’s ease of use, and the quality of customer service when making your decision.

Long-Term Investing vs. Short-Term Trading

There are different strategies you can adopt when investing in the stock market. We’ll cover just a few here, but take a look at this article for a closer look at different types of investment strategies.

Long-Term Investing: This involves buying and holding stocks for several years. Long-term investors believe that in the long run, the market will provide a good rate of return despite periods of volatility or decline. Warren Buffett, one of the most successful investors of all time, is a notable proponent of long-term investing.

Short-Term Trading: This involves buying and selling stocks within a short period, often within a day (known as day trading). Short-term traders aim to profit from short-term price fluctuations. While it can offer high returns, it’s also riskier and requires more time and expert knowledge.

Understanding and Managing Investment Risks

Investing in the stock market involves various types of risks. Understanding these risks can help you make informed decisions and protect your investments.

Market Risk: This is the risk that the overall market will decline, negatively affecting the price of most stocks regardless of the individual companies’ performance. For instance, during the 2008 financial crisis, even well-performing companies like Apple saw their stock prices fall.

Company Risk: This is the risk that a company will perform poorly or go bankrupt, causing its stock price to drop. For example, if a company like Ford Motor Co. reports lower-than-expected earnings, its stock price might decline.

Industry Risk: This is the risk that a particular industry will perform poorly. For instance, if the government passes regulations that negatively affect the pharmaceutical industry, stocks of companies like Pfizer and Merck might suffer.

Inflation Risk: This is the risk that the rate of inflation will exceed the return on your investment. If you invest in a stock that returns 2% but inflation is 3%, your real return is actually negative.

Interest Rate Risk: This is the risk that a change in interest rates will negatively affect the price of your stocks. When interest rates rise, stock prices generally fall.

Tax Considerations for Stock Investors

When you sell a stock for more than you paid for it, you have a capital gain, which may be subject to capital gains tax. The rate of this tax can depend on several factors, including how long you held the stock and your overall income level.

For example, if you bought a share of Google for $1,000 and sold it for $1,500, you would have a capital gain of $500. Depending on your tax bracket and how long you held the stock, you might owe capital gains tax on this $500.

Tax-Advantaged Accounts: Certain types of investment accounts offer tax advantages. For instance, with a traditional Individual Retirement Account (IRA) or a 401(k), you can deduct your contributions from your income, reducing your taxes for the year. The investments in the account grow tax-deferred, meaning you don’t pay taxes on the gains until you withdraw the money in retirement.

To get the most out of your investment portfolio you could also consider other tax-effective strategies such as investing via a discretionary trust.

Regular Monitoring and Rebalancing

Once you’ve made your investments, it’s important to monitor them regularly. The performance of your stocks, changes in the market, or changes in your financial goals might necessitate adjustments to your portfolio.

Rebalancing: Over time, some of your investments might perform better than others, causing your portfolio to drift from its target allocation. Rebalancing involves selling investments that make up too large a portion of your portfolio and buying those that make up too small a portion. This can help maintain your desired level of risk and return.

Investing in the US stock market can be rewarding, but it requires knowledge, patience, and discipline. By understanding the basics, setting clear financial goals, choosing the right stocks, and managing your risks, you can navigate the market with confidence.

Remember, investing in the stock market involves risk, and it’s possible to lose money. Always do your research and consider seeking advice from a financial advisor before making investment decisions.