If you’re undertaking fundamental analysis on companies or stocks to potentially invest in, the Equity Multiplier is an important metric to understand. The equity multiplier ratio can provide important insights into a company’s financial health and its approach to debt and equity financing. But what exactly is the equity multiplier, and why should it matter to your investment decisions?

- What Is the Equity Multiplier? (Definition)

- The Formula: How to Calculate the Equity Multiplier

- Interpreting the Equity Multiplier: High vs. Low

- Benefits and Uses: Why the Equity Multiplier Matters

- Equity Multiplier Practical Examples: Apple vs Verizon

- Equity Multiplier and Other Financial Ratios

- Risks and Limitations: What to Watch Out For

- Wrapping Up: Why Equity Multiplier Matters

- Additional Resources: Further Your Financial Savvy

- Frequently Asked Questions

What Is the Equity Multiplier? (Definition)

The equity multiplier is a financial ratio used during the process of fundamental analysis to measure how much of a company’s assets are financed by stockholders’ equity. In simpler terms, it gives you a quick snapshot of a company’s debt situation compared to its equity. Why does this matter? For starters, this metric is a key indicator of the company’s financial leverage, or its reliance on debt versus equity to fund its assets.

Understanding a company’s equity multiplier can help both investors and creditors:

The Formula: How to Calculate the Equity Multiplier

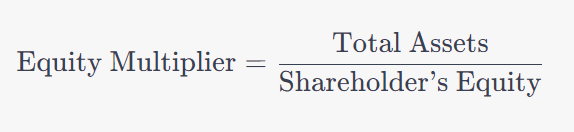

The equity multiplier is calculated with a simple formula:

There are two key components of this formula: Total Assets and Shareholder’s Equity.

Total Assets

Total Assets encompass everything the company owns that holds value. This can range from cash and inventories to buildings, land, and intellectual property. All of these are found on the company’s balance sheet under the “Assets” section. They are categorized as either current assets, which can be easily converted to cash within a year, or non-current assets, which can’t. Together, these represent the financial resources a company has at its disposal for operations and investment.

Shareholder’s Equity

Also known as stockholder’s equity, this term represents the net value that would belong to the shareholders if the company sold off all its assets and paid off all its liabilities. Simply put, it’s what’s left for the owners of the company after settling all debts. You can find this information on the balance sheet as well, under the “Equity” section. Shareholder’s equity is calculated as Total Assets minus Total Liabilities.

To calculate the equity multiplier, all you need to do is divide the Total Assets by Shareholder’s Equity. The resulting ratio—known as the equity multiplier—will tell you how many times the company’s assets are financed by equity.

Example: Let’s assume Company X has total assets of $1 million and shareholder’s equity of $250,000. To find the equity multiplier, you’d divide $1,000,000 by $250,000, which gives you an equity multiplier of 4. This means that for every dollar of equity, there are four dollars in assets.

Interpreting the Equity Multiplier: High vs. Low

So, you’ve crunched the numbers and have your equity multiplier figure in hand. What now? Understanding what this number represents can provide invaluable insights into a company’s financial health and strategies.

High Equity Multiplier

A high equity multiplier typically indicates that a large portion of the company’s assets are financed by debt rather than equity. While this can signal higher financial leverage and risk, it’s not necessarily a bad thing. High debt levels can also mean that a company is aggressively investing in growth opportunities. However, a higher equity multiplier also carries a greater financial risk, especially if the company fails to generate enough return on its investments.

Low Equity Multiplier

On the flip side, a low equity multiplier suggests that the company relies more on equity financing from shareholders than on debt. This often implies lower risk but also signifies that the company might be more conservative in its investment strategies. Such companies might have a slower growth rate, as they are not taking on much debt to finance aggressive expansion.

Example: Using the previous example of Company X with an equity multiplier of 4, this could indicate a higher risk strategy, leaning heavily on debt to finance its assets. It may warrant a closer look to evaluate if this strategy aligns with your investment goals and risk tolerance.

Benefits and Uses: Why the Equity Multiplier Matters

Understanding the equity multiplier isn’t just an academic exercise; it has real-world applications that can affect your bottom line. Whether you’re an investor, a creditor, or a business owner, this financial ratio can offer you valuable insights.

Advantages for Investors

For investors, the equity multiplier can be a critical tool in financial risk assessment, and understanding if a particular stock aligns with your investment strategy. When a company has a high equity multiplier, it usually means that the firm is using more debt to finance its operations and investments. This level of financial leverage can amplify the returns on your investment if the company performs well. Simply put, a company that can borrow money to invest in high-yielding projects could offer you a higher return on your equity. However, it’s a double-edged sword. If the investments don’t pan out, the losses are also amplified, making the investment riskier.

As an investor, you might want to take the following into consideration:

Advantages for Creditors

Creditors also have much to gain from examining the equity multiplier. For them, a high ratio may serve as a warning sign, indicating that the company is already saddled with substantial debt. In contrast, a low equity multiplier could imply less financial risk, suggesting that the firm could take on additional debt responsibly.

Industry Standards

You can’t fully appreciate a company’s equity multiplier without considering the industry context. By comparing a firm’s multiplier to industry standards or averages, you gain a clearer picture of its financial leverage ratio. This industry-based comparison is especially helpful in evaluating a company’s competitive stance and overall health.

With this enhanced understanding of the equity multiplier’s benefits and uses, you’re better equipped to make well-informed decisions. It’s not just a number; it’s a gauge of financial stability, risk, and potential for return on investment.

Equity Multiplier Practical Examples: Apple vs Verizon

Understanding theory is great, but seeing it in action is even better. Let’s look at two contrasting examples from the tech industry: Apple and Verizon. Both are giants in their fields, but as you’ll see, their approaches to financing are quite different.

Apple’s Low Equity Multiplier

Apple, known for its strong brand and huge cash reserves, traditionally has a low equity multiplier. This suggests that Apple doesn’t rely heavily on debt to finance its operations. It leans more toward using its equity, i.e., money from shareholders or reinvested profits. As an investor, this might give you some assurance that Apple takes on lower financial risk.

How to Find Apple’s Equity Multiplier: You can usually find this information in the company’s annual report, under the balance sheet section. Divide the total assets by the shareholder’s equity, and you’ll get the equity multiplier ratio.

Verizon’s High Equity Multiplier

Verizon, on the other hand, operates with a higher equity multiplier. This implies that the company takes on more debt to finance its operations, potentially aiming for rapid expansion or higher returns. However, this also signals a higher level of financial risk, which might be a red flag for conservative investors.

How to Find Verizon’s Equity Multiplier: Much like Apple, you’d sift through Verizon’s annual report. Locate the balance sheet and divide the total assets by the shareholder’s equity.

Industry Average

To put these numbers in context, it’s useful to compare them to the industry average. Knowing how Apple and Verizon stack up against their competitors can give you additional insights into their financial strategies and risk profiles.

These real-world examples from Apple and Verizon illustrate how companies can have different financial strategies reflected in their equity multipliers. Whether you’re risk-averse or looking for a potentially high return, understanding a company’s equity multiplier can give you an edge in making more informed investment decisions.

Equity Multiplier and Other Financial Ratios

You might think of the equity multiplier as a single actor on a larger stage of financial ratios. Knowing how this actor interacts with others like debt ratio, return on equity (ROE), and DuPont analysis can give you a richer understanding of a company’s financial performance.

The Debt Ratio Connection

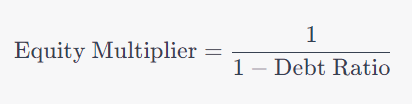

First, let’s consider the debt ratio. This ratio helps you see how much of a company’s assets are financed by debt, as opposed to the equity multiplier, which shows how much is financed by shareholders’ equity. A full picture comes into view when you look at both ratios side by side.

How to Find the Equity Multiplier from the Debt Ratio: For those keen on the math, the equity multiplier can be calculated from the debt ratio using this formula:

ROE: Return on Equity

Return on Equity (ROE) is another ratio that tells you how well a company is using its equity to generate profits. When looked at in conjunction with the equity multiplier, these two can provide a deeper insight into a company’s financial performance.

DuPont Analysis: Beyond the Surface

Now let’s talk about DuPont analysis, which can offer more nuanced information that you might miss when only looking at the equity multiplier.

Example: Imagine Company XYZ has a high ROE and a high equity multiplier. At first glance, you might think, “Great, they’re using their equity efficiently to generate profits.” But upon running a DuPont analysis, you find out that the company’s net profit margin is actually low, and the high ROE is primarily because of the high financial leverage indicated by the equity multiplier.

Why This Matters to Investors: As an investor, you should care because a high ROE driven by financial leverage rather than actual profitability can be risky. If the company’s investments don’t pan out, that high leverage can result in significant losses. So, using DuPont analysis helps you dig deeper, beyond what the simple equity multiplier can tell you.

Risks and Limitations: What to Watch Out For

While the equity multiplier is a valuable tool, it’s not without its downsides. Like any metric, it’s just one piece of a much larger financial picture. Relying solely on this ratio can sometimes lead you astray.

A sensible investor will consider the following when assessing a company’s equity multiplier:

Wrapping Up: Why Equity Multiplier Matters

You’ve come a long way in understanding the ins and outs of the equity multiplier. It’s a powerful financial ratio that shows how much of a company’s assets are financed by shareholders’ equity as opposed to debt. While a high equity multiplier can indicate high financial leverage, a low one often suggests lower risk but potentially lower returns as well.

Why It’s Crucial for Investors: For investors, this metric is vital because it provides insights into a company’s financial structure and risk profile. A high equity multiplier could mean higher returns, but it also comes with higher risks. Conversely, a low equity multiplier typically signifies a more stable but possibly less dynamic investment.

Financial Analysis: In financial analysis, this ratio is one tool among many. While it offers a quick snapshot, it’s not a standalone metric. Pairing it with other financial ratios, like debt ratio or return on equity, can provide a more comprehensive view of a company’s financial health.

What Does the Equity Multiplier Mean?: In the simplest terms, the equity multiplier meaning boils down to how a company uses debt versus equity to finance its assets. It’s a clue into the financing decisions the company has made, which in turn, can influence its long-term viability and growth prospects.

So there you have it! The equity multiplier is an indispensable tool for anyone interested in investing or financial analysis. Whether you’re assessing the potential risks or rewards of an investment, or trying to get a fuller picture of a company’s financial landscape, this ratio should definitely be in your analytical toolbox.

Additional Resources: Further Your Financial Savvy

Knowledge is power, especially when it comes to making informed financial decisions. If you’re keen to dive deeper, here are some resources to consider:

Books on Investment Strategies

Books like The Intelligent Investor by Benjamin Graham or Common Stocks and Uncommon Profits by Philip Fisher are excellent starting points to broaden your investment knowledge.

Tools for Analyzing Capital Structure

If you’re really into the numbers, various online tools and platforms like Morningstar can help you analyze a company’s capital structure, making sense of metrics like the equity multiplier and total shareholder equity.

Reading Financial Reports

Learning to read financial reports can be a game-changer. These documents contain valuable data, including information about a company’s liabilities, assets, and equity, which is key for your financial analysis. Websites like the U.S. Securities and Exchange Commission’s EDGAR database provide access to a plethora of these reports.

Websites and Blogs

Websites like Investopedia and Seeking Alpha offer in-depth articles that can help you understand more complex terms like ‘current creditors’ and ‘additional cash flows.’

Online Courses

Consider enrolling in an online course that focuses on investment strategies or financial analysis. Platforms like Coursera and Udemy offer courses that can be both affordable and valuable.

Whether you’re an aspiring investor or someone keen on understanding the intricacies of financial metrics, these resources can offer valuable insights. Happy learning and investing!

Frequently Asked Questions