So, you want to be rich and retired by the time you’re 25? How old do you have to be to invest in stocks? If you’re under 18, are you even allowed to start investing? While there’s no guaranteed path to early wealth, understanding how stock investing works is a solid start. When you start getting into investing, there can be a lot to learn. But strip away the complexities, and you’ll find principles that can guide even the youngest investors.

- What are Stocks?

- Why Start Investing?

- How Old Do You Have To Be To Invest In stocks?

- Alternative Options for Younger Investors

- Tax Free Investments for Education

- Get Started with a Brokerage Account

- Robo-Advisors and Investment Apps

- Investing in Your Education

- Benefits of Starting Early

- Wrapping Up: How Old do You Have to be to Invest in Stocks?

- Frequently Asked Questions

What are Stocks?

Although there are many different types of investments, stocks are a form of equity that basically represents a share in the ownership of a company and constitutes a claim on part of the company’s assets and earnings. When you buy individual stocks, you become a shareholder, which means you now own a piece of that company. Think of it as owning a slice of a pizza, where the pizza represents the company. The more slices (or stocks) you have, the bigger your share of the pie.

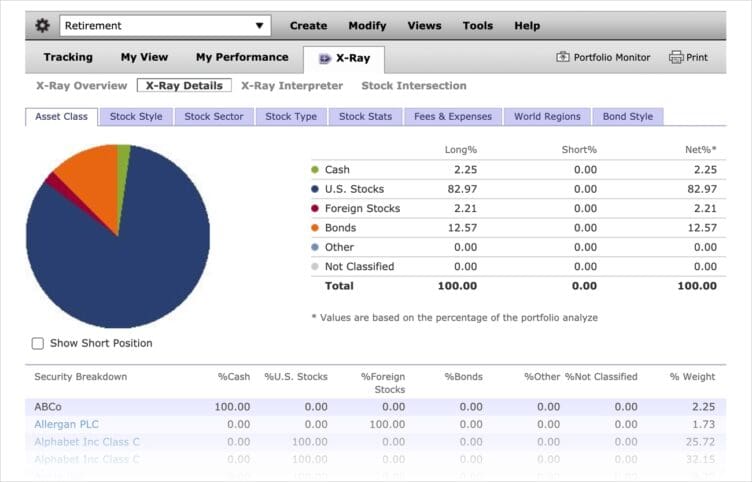

While stocks offer a stake in a company’s equity, bonds represent a form of debt where you lend money to an entity, typically a corporation or government. In return, the issuer of the bond agrees to pay you periodic interest and return the principal amount after a set term such as 3, 5, or 10 years. Diversifying your portfolio with both stocks and bonds can provide balance. While stocks have the potential for higher returns, they come with greater volatility. Bonds, on the other hand, often provide more stable, predictable income. By holding both, you can aim for growth through equities and stability with bonds, optimizing potential returns while managing risk.

Stocks and bonds are traded on exchanges, places where buyers and sellers come together, and the price of a stock is determined by supply and demand. Some of the most well-known exchanges include the New York Stock Exchange (NYSE) and the Nasdaq.

Why Start Investing?

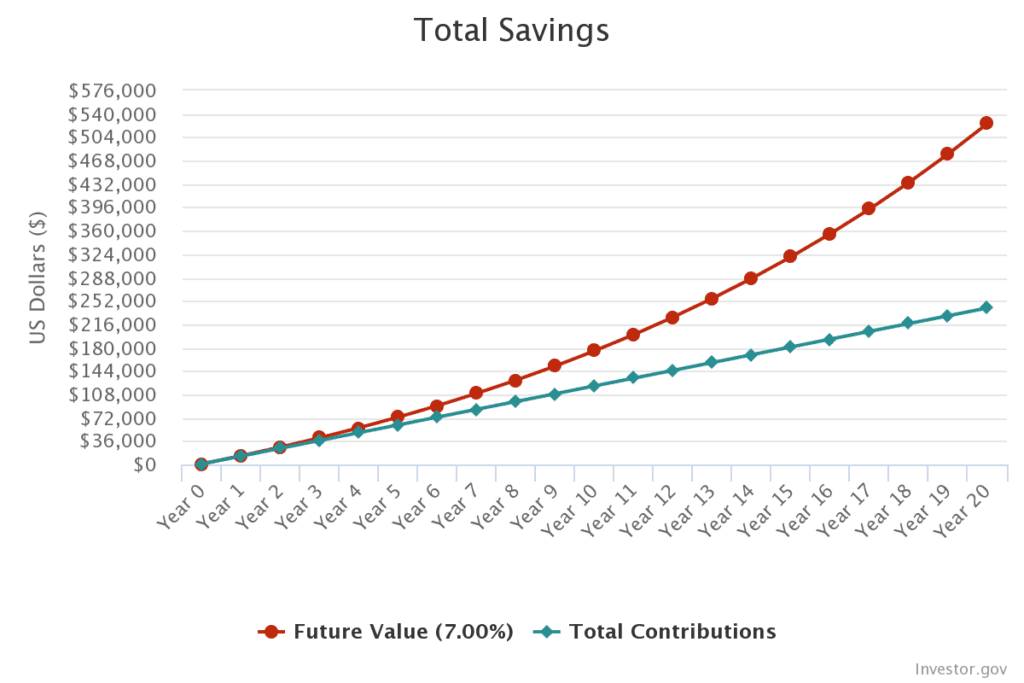

Investing in stocks is a way to grow your wealth over time. While there are risks involved, historically, the stock market has returned about 7% annually after inflation. This means that if you invest wisely and hold onto your stocks for a long time, there’s a good chance you’ll see a decent return on your investment.

Assuming 7% average return, if you invest $1,000 per month, after ten years you would have $175k, even though you’ve only invested $120k. If you keep investing the same monthly amount for 20 years, you will end up with half-a-million dollars and will have doubled your money on your $240k total investment.

But why invest in stocks? Well, there are a few reasons:

How Old Do You Have To Be To Invest In stocks?

Most countries have legal age requirements for opening a brokerage account and to start trading stocks (also known as the ‘age of majority’). In the US in general, you must be at least 18 years old to invest on your own. But if you’re younger than 18 (the age of majority for most of the US), you can still get involved in the stock market via custodial accounts or investment clubs.

How old do you have to be to invest in stocks outside the US? Different countries have their own regulations regarding the minimum age to invest in stocks:

However, in most countries and jurisdictions, with parental consent, minors can have a custodial account set up in their name.

Alternative Options for Younger Investors

Custodial accounts

If you’re not yet the age of majority, a custodial brokerage account is a fantastic option, whether it be a standard brokerage account or a Roth IRA. These accounts are opened on your behalf and managed by a custodian, usually a parent or guardian, until you reach the legal age in your state or country. The money in a custodial brokerage account belongs to you, and any investment decisions are made by your parents.

There are two main types of custodial accounts:

If you have taxable income, your parent or guardian can open a custodial retirement account, or Roth IRA account for you.

While custodial accounts offer a way for you to own assets if you’re under the legal age, once you reach the legal age, you gain full control over these types of investment accounts. This means you can use the funds however you see fit, whether that’s for college tuition, travel, or any other purpose.

Investment Clubs or Groups

Another alternative is joining or forming an investment club or group.

An investment club is a collective group of people who pool their resources to invest together. Typically consisting of 10 to 20 members, these clubs often form a legal entity, such as a partnership or LLC, to manage investments. As a member of the group you contribute a fixed amount regularly to the club’s fund and make investment decisions based on majority or unanimous votes during regular meetings. These meetings serve dual purposes: to discuss potential investment opportunities and to share knowledge, ensuring all members are informed and educated about their collective investments.

The structure of an investment club includes designated roles for members, such as president or treasurer, to oversee specific operations. If you choose to leave the club, you receive your share of the club’s assets after accounting for any associated costs. Profits or losses from investments are distributed among members based on their proportional ownership. Trust and transparency are foundational in these clubs, with all financial decisions and transactions being open to scrutiny by all members.

Tax Free Investments for Education

Investing Early with the 529 Plan

The 529 plan is another option to consider since it offers special savings available even for those not old enough to invest directly. This unique savings account is designed to help families or individuals save for future education expenses, such as college, university, or even private K-12 school tuition.

While you may be too young to manage your own stock portfolio, a 529 plan can offer you a way to indirectly invest in the stock market. The contributions made to these plans are invested, often in stocks or bonds, depending on the plan’s specific options. The primary advantage here is that any earnings from the investments are tax-free if used for qualified education expenses. This can encompass tuition, books, room and board, and other necessary educational costs. As the money grows, thanks to compound interest and market gains, you can benefit from early investment without being directly involved.

There are two primary types of 529 plans. One is the prepaid tuition plan, which lets you pay for future college costs at today’s rates. It’s a proactive approach against potentially rising tuition fees. The other, the education savings plan, works more like a traditional investment account where your contributions are invested, and they can grow based on those investment returns. Every state typically has its own set of 529 plans, so you should explore what’s available in your area. Remember, even if you’re not old enough to invest in stocks directly, tools like the 529 plan can provide an early start to financial growth.

Investing Early with an Educational IRA

Another option is the Education IRA, more commonly known today as the Coverdell Education Savings Account (ESA). The Coverdell ESA provides a pathway for you to benefit from stock investments, even if you can’t directly own or manage stock portfolios yourself.

The Coverdell ESA is designed to help you and your parents set aside funds for future educational expenses. Much like the 529 plans, the funds contributed to a Coverdell ESA are invested in a range of options like stocks, bonds, or mutual funds, based on the choices available in the specific account. The beauty of these accounts lies in their tax benefits. Although contributions are post-tax, the earnings grow tax-free, and withdrawals for qualified education expenses are not taxed. This can cover costs ranging from elementary school expenses all the way up to graduate school, giving a broad spectrum of utility.

One of the most significant differences between a Coverdell ESA and a 529 plan is the types of allowable educational expenses. While 529 plans primarily focus on post-secondary education costs, a Coverdell ESA can be used for both primary and secondary school expenses. This means that funds from a Coverdell can be withdrawn tax-free for costs related to elementary or high school, such as tuition for private or religious schools, uniforms, or even tutoring.

However, there are specific nuances to be aware of. Coverdell ESAs come with annual contribution limits, and the total amount that can be contributed each year is $2,000. And, there are income restrictions on who can contribute. But the real benefit is the way they enable early exposure to stock investments. A parent or guardian can invest the ESA contributions in stocks, allowing you to indirectly benefit from stock market growth. By the time you’re of age to manage your own investments, you should already have a good understanding of stock market investing, courtesy of instruments like the Coverdell ESA.

Get Started with a Brokerage Account

Online brokerages have made it easier than ever to start investing in stocks, some with an initial investment of only $5. These platforms offer a range of tools and resources to help both beginners and seasoned investors navigate the stock market. Within your brokerage account you will be able to invest in individual stocks, as well as mutual funds, index funds, and exchange-traded funds.

Before choosing a platform, do your own research. Each brokerage has its own set of portfolio management tools, fees, and features, such as being able to buy fractional shares.

Robo-Advisors and Investment Apps

Robo-advisors are digital platforms that provide automated, algorithm-driven financial planning services with little to no interaction with an actual person. They are great if you prefer a hands-off investment approach. On the other hand, investment apps are very easy to use and have opened up stock trading to the masses.

Investing in Your Education

Financial education is the most important starting point and the cornerstone of successful investing. The more you know about how investing works, the better equipped you’ll be to make the best informed decisions. Luckily, there are a lot of resources to help expand your knowledge.

Benefits of Starting Early

There are lots of good reasons to start investing in stocks as soon as possible:

Wrapping Up: How Old do You Have to be to Invest in Stocks?

Just because you’re under 18, that doesn’t stop you from investing in the stock market. The best way most young people start investing is by having a parent or guardian open a custodial account. You could also consider joining an investment club. This also allows you to start investing if you’re not of the legal age.

Financial education is one of the most important factors in becoming a successful investor. The one predictable thing about the stock market is that it is unpredictable. But having plenty of knowledge and having done your research, you can ride the stock market’s ups and downs more confidently. Whether you’re looking to invest on your own or you’re a parent hoping to teach your kids how to be financially literate, keep in mind that the journey is just as important as the destination. Every investment, big or small, is a step towards financial independence and financial security.

Legendary investor Warren Buffett once said, “The stock market is a device for transferring money from the impatient to the patient.” So, arm yourself with knowledge, be patient, and let the stock market do its magic.

Frequently Asked Questions