Investing your money in the stock market is a smart way to make it work for you and achieve long-term financial growth. If you’re a beginner, the concept of investing may seem overwhelming, with many unfamiliar terms and ideas. However, investing doesn’t have to be complicated. In this part one of a three part series, we will walk you through the basics of investing that anyone can understand. We’ll cover the reasons why you should invest, how to invest, and what to invest in. Additionally, we’ll discuss basic beginner strategies, and address frequently asked questions.

In this article

The Importance of Investing

Investing is one of your most important tools to ensure your money grows over time. If you simply keep your savings in a traditional savings account, the interest rates offered by banks are generally quite low. Major banks like Chase or Wells Fargo might offer as little as 0.01% or 0.15% interest on your money. Consider this: if you were to deposit one million dollars into a savings account with a 0.01% interest rate, you would earn only one hundred dollars in a year. Clearly, in this scenario your money isn’t working hard for you. Investing, on the other hand, enables your money to compound over time.

Compound Interest

Compound interest refers to the interest you earn on your initial investment and any accumulated interest. Imagine you invest one thousand dollars and receive a 10% return in the first year. At the end of year one, you’ll have $1,100. In year two, if you again earn a 10% return, you’ll end up with $1,210. After 20 years, your initial investment of $1,000 will have grown to $6,727. By simply investing and consistently earning a return, your money starts to grow exponentially through the power of compounding.

Inflation

Another reason to invest instead of keeping excess cash in a savings account is the impact of inflation. In the United States, the Federal Reserve sets an annual target inflation rate of 2% to maintain a healthy economy. However, recently inflation rates are as high as 6% to 8% per year. If your money isn’t earning at least the inflation rate, its purchasing power decreases over time. To witness inflation in action, consider the cost of postage stamps. In 1971, a stamp cost eight cents, but today, it costs 63 cents to mail a letter. This price increase is a result of inflation. Investing helps mitigate the effects of inflation and preserves the value of your money.

How to Start Investing

Investing in the stock market is just one of many various investment strategies. You can invest in companies by purchasing stocks, in real estate by buying properties, or even in collectibles such as rare cards. However, for the purpose of this article, we’ll focus on investing in the stock market, which is the most common and predictable form of investment over the long term.

Investing in Stocks

Investing in stocks involves buying shares of publicly traded companies. The financial success of a company directly affects the performance of your investment. When a company performs well, the value of your investment increases. The key to successful stock market investing is to hold onto your investments for an extended period. Generally, a holding period of over 10 years yields the best results. Let’s examine an example of stock market returns using the S&P 500 Index.

An Example of Stock Market Returns

The S&P 500 Index represents the top 500 companies in the United States. If we observe the historical performance of the S&P 500, we can see a consistent upward trend over time, despite occasional dips and crashes. Since its inception in 1957, the S&P 500 has provided an average annual return of 8% to 10%. Suppose you had invested $100 in the stock market back in 1980. Adjusted for inflation, that $100 would be worth around $360 today. However, invested in the stock market, due to the compounding effect your investment would have grown approximately 27 times, resulting in a value of $2,777. Investing in the stock market allows your money to grow significantly, ensuring you don’t miss out on potential returns.

What to Invest in as a Beginner

Now that we understand the importance of investing and how to invest in the stock market, let’s discuss what assets you should consider investing in as a beginner.

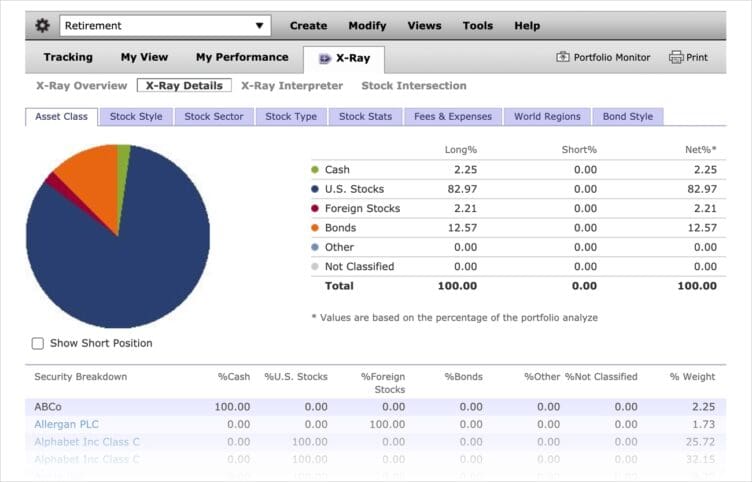

Diversified Index Funds

Diversified index funds offer a low-risk investment option for beginners. These funds replicate the performance of a broad market index such as the S&P 500 or Dow Jones Industrial Average (DJIA). They providing instant diversification across various companies and sectors. By investing in index funds, beginners can reduce the risk associated with individual stock picking and gain exposure to the overall market’s growth potential. These passively managed funds come with lower expense ratios and are easily accessible through online platforms, making them a convenient and cost-effective choice for those starting their investment journey.

Fidelity ZERO Large Cap Index (FNILX) and Schwab S&P 500 Index Fund (SWPPX) are two popular index funds.

Diversified index funds are a low-risk investment option for beginners. They provide diversification, cost-effectiveness, and long-term growth potential. By investing in these funds, beginners can reduce risk, gain exposure to the overall market, and take advantage of the simplicity and convenience offered by online platforms.

Exchange-Traded Funds (ETFs)

Exchange-Traded Funds (ETFs) have gained significant popularity in recent years as a versatile investment option. Similar to index funds, ETFs provide the benefits of diversification and low expense ratios. However, what sets ETFs apart is their ability to trade on stock exchanges like individual stocks. This flexibility allows investors to buy and sell ETF shares throughout the trading day at market prices. ETFs track various market indexes or specific sectors, providing investors with exposure to specific industries or asset classes. Whether you want to invest in technology, healthcare, real estate, or emerging markets, there’s likely an ETF available to suit your investment goals.

Vanguard S&P 500 ETF (VOO) tracks the S&P 500 index, and is one of the largest funds on the market.

Blue-Chip Stocks

When it comes to stability and reliability, blue-chip stocks are often the go-to choice for investors. These stocks represent shares of well-established, financially stable companies with a long-standing history of consistent performance. Known for their market leadership and brand recognition, blue-chip companies are considered industry giants and household names. One of the significant advantages of investing in blue-chip stocks is the potential for regular dividend payments. These companies often distribute a portion of their profits to shareholders in the form of dividends, providing a steady income stream along with the potential for long-term capital appreciation. Investors seeking a balance of stability and growth often include blue-chip stocks in their investment portfolios.

Apple (AAPL) and Coca-Cola (KO) are two of the most popular blue-chip stocks being up there with the most profitable companies in the world.

Bonds

Bonds offer investors an alternative avenue for generating income and preserving capital. When you invest in bonds, you essentially become a lender to governments, municipalities, or corporations. In exchange for lending your money, the issuer promises to repay the principal amount upon maturity and pay regular interest payments (known as coupon payments, usually around 1% – 4%) during the bond’s term. Bonds are generally regarded as less volatile than stocks and are often considered a more conservative investment option. They provide fixed income streams, making them particularly attractive for investors seeking stable cash flows. Bonds come in various forms, including government bonds, municipal bonds, corporate bonds, and treasury bonds, each with its own risk profile and potential returns. As part of a well-diversified portfolio, bonds can provide stability and act as a counterbalance to more volatile investments like stocks. In addition to the guaranteed interest payment, if interest rates fall the price of a bond increases, and you could make a profit selling your bond rather than holding it until maturity.

U.S. Treasury bonds are considered the safest in the world and most investors regard them as “risk-free”, whilst I Savings Bonds are a great way to earn interest and protect yourself from inflation.

Wrapping Up

Investing doesn’t have to be overwhelming, even for beginners. By understanding the reasons to invest, the power of compound interest, and the impact of inflation, you can make informed decisions about growing your money. Investing in the stock market, particularly through diversified index funds, ETFs, blue-chip stocks, and bonds, provides an opportunity for long-term financial growth. Remember, the key is to hold onto your investments for a considerable period to benefit from compounding and predictable market returns.