The Investment Journey: Patience is Key

Choosing an investment strategy could be compared to a strenuous hike on a mountain trail. Imagine setting out on an unexplored path, promising a breathtaking view at the end. The trek begins, your spirits are high, and you’re filled with anticipation. Five minutes into your journey, the trail you’re on seems to be going nowhere, and another trail catches your eye. This path seems more crowded with hikers, bustling with energy and activity. You wonder, “Perhaps there’s something interesting happening on that trail”. Succumbing to the allure of the crowd, you veer off your original path and start walking on this new one.

But as time passes, you notice a group of hikers marching back towards the original trail. A feeling of unease creeps in, and you start questioning your decision to switch paths. This narrative of shifting trails based on where the majority seems to be heading is a good analogy of the indecisiveness and fickleness investors often exhibit when it comes to choosing their investment strategies.

Progress Over Speed in Investing

As with reaching the end of your hiking trail, your primary focus should be on making steady progress towards your ultimate financial goal. It’s easy to get swept away by the temptation to switch investment strategies when another one appears to be providing higher short-term returns, much like the temptation to switch hiking trails. However, such quick shifts may prove to be counterproductive in the long run.

Take, for instance, the case of dividend investors in 2022, who were on the receiving end of significant benefits. However, as we transition into 2023, the landscape seems to have undergone a drastic change. If we scrutinize the performance of the FTSE High Dividend Yield Index, we can see that it’s down by about two percent for the year, a stark contrast to the S&P 500 that’s up by over 15 percent. The sight of your portfolio underperforming the S&P 500, or perhaps even the portfolios of your colleagues, can be quite disheartening. This discrepancy could tempt you to jump ship and switch strategies, but is that a sensible choice? History suggests it might not be.

Vanguard Study

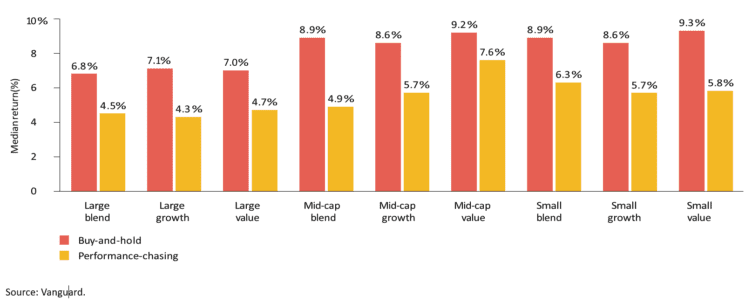

Vanguard, conducted an insightful study that spanned from 2004 to 2013. This study evaluated the performance of a hypothetical investor who chased performance against an investor who followed the Buy and Hold strategy. The results were interesting, to say the least. The Buy and Hold investor significantly outperformed the performance-chasing investor across various fund categories. This revelation underscores the virtue of patience in investing and highlights the potential pitfalls of making impulsive switches between investment strategies.

Comparing Two Investment Approaches

The first type of investor, termed ‘the performance chaser,’ was hypothesized to invest in any mutual fund that displayed higher-than-average three-year annualized performance. The researchers assumed that this type of investor would promptly sell these funds anytime they exhibited below-average three-year performance.

Conversely, the Buy and Hold investor was assumed to invest in all funds, irrespective of whether they outperformed or underperformed during the previous three years. This investor didn’t let short-term performance variations affect their investment decisions and instead focused on long-term gains.

Findings From the Vanguard Study

The results of Vanguard’s study were eye-opening. The Buy and Hold investor didn’t just outperform the performance-chasing investor but did so by a substantial margin. This pattern held true across all fund categories studied, painting a clear picture of the benefits of the Buy and Hold strategy.

The underperformance of the performance chasers ranged from 5 percent in the mid-cap blend category to a slight 1.6 percent in the same category. But what was more striking was that even the worst-performing Buy and Hold strategy – the large cap blend with just 6.8 percent annual returns – still outperformed every performance chasing investor in every category, bar one.

The mid-cap value performance chaser returned 7.6 percent. However, the other eight categories saw underperformance even when compared to the worst-performing category on the Buy and Hold basis. In essence, even if an investor selected the worst performing category over this period – the large cap blend strategy – they would have yielded better results than eight out of nine performance chasers.

The Pitfalls of Performance Chasing

Complicating the situation is that most investors don’t just chase performance within categories, but they also do so across categories. When large cap blend underperforms, they shift their focus to small cap value, mid-cap growth, or whichever has been the top-performing specific subcategory. This tendency often leads to hasty decisions and can jeopardize long-term investment goals.

The message for investors from this study is unambiguous. Rather than oscillating between growth and value, dividends and back to growth, it’s far more beneficial to identify a robust, suitable investment strategy and stick to it. In the investment world, it appears that steadiness may indeed win the race.

The Power of Patience and Dividend Growth

Consistency, coupled with an understanding of fundamental drivers of long-term performance, can yield tremendous results. One such driver is dividend growth. A hypothetical investment of one million dollars in a portfolio with a 2.8 percent dividend yield will generate roughly twenty-eight thousand dollars in the first year. Now, let’s assume a seven percent per year increase in dividends. This compounding effect can dramatically boost the income generated by your portfolio, irrespective of the changes in market value.

By focusing on your portfolio’s progress rather than its speed relative to other investment strategies or portfolios, you can effectively navigate the investment journey. If your portfolio continues to meet your specific financial needs, there’s no reason to switch strategies. As in our hiking trail analogy, what matters is not the speed at which you reach the destination, but the fact that you reach it in the end.