Most credit cards come with a consolidated view of your monthly expenses, allowing you to effortlessly track and categorize where your money goes. Pair this with the other tools and features many card issuers now offer, such as detailed spending breakdowns and instant transaction alerts, and managing your budget just got a whole lot easier. Plus, when you charge your regular expenses to a credit card, you’re in a prime position to reap rewards, cash-back, or points, turning your everyday purchases into potential bonuses.

Understanding Your Credit Card Basics

Basics of a Credit Card

Before you can use a credit card effectively to help manage your budget, understanding the basics of your credit card is essential. A credit card is essentially an agreement between you and a card issuer, like American Express or Capital One, that allows you to borrow a certain amount of money up to a predetermined credit limit. But it’s not free money – you’re expected to repay what you’ve borrowed, usually with interest. If you’re new to credit cards or considering getting one, here’s what to know before getting a credit card, and the steps you should follow to ensure your credit application is approved.

One of the most important terms to understand is the Annual Percentage Rate (APR). The APR is the interest rate you’re charged for borrowing money when you don’t pay off your full balance by the due date. It’s how the credit card issuer makes money and why it’s in your best interest (pun intended) to pay off your balance in full each month. When you do, many cards offer a grace period, which means you won’t be charged any interest on your balance.

Decoding Your Credit Card Statement

Every month, you’ll receive a credit card statement, either in the mail or electronically, detailing all your transactions for that period. At first glance, it might seem like a lot, but it’s easier than you think to understand. Your credit card statement is one of your best tools to help you create and track your budget. Here’s a quick breakdown:

Always review your statement for any errors or unfamiliar transactions. Do this without fail every month. If something looks off, contact your credit card issuer immediately.

Differences Between Debit and Credit Cards

Debit and credit cards might look similar, but they function very differently. With a debit card, when you make a purchase, the money is directly withdrawn from your bank account. On the other hand, a credit card lets you borrow money from the card issuer up to a certain limit, which you’ll need to repay. One isn’t necessarily better than the other; it’s more about how you use them in your financial strategy.

Practical Strategies for Credit Card Budgeting

Use Your Credit Card Providers’ Reporting Tools

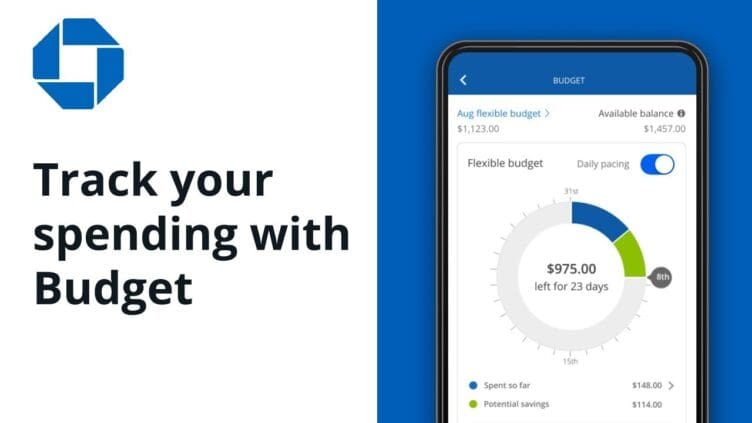

Many credit card companies offer tools to help you manage and understand your expenses better. These tools categorize your spending into areas like dining, entertainment, groceries, and travel. For instance, Chase has a budgeting feature in their app that breaks down your monthly spending by category. Alternatively, you can make use of popular personal budgeting apps to keep track of all your expenses. By making use of these tools, you can get a clear picture of where your money is going. Whether you’re a single mom or looking for budgeting tips for large families these tools can help you understand which areas might require a budget adjustment. Recognizing patterns, such as consistently overspending on dining out or special occasions like a 40th birthday party, can lead to more informed financial decisions for the rest of the month, or in the following months.

Using your credit card’s expense categories makes it simple to check if you’re sticking to the 50/30/20 rule and helps you identify if you’re overspending on wants rather than focusing on needs.

Set Up Account Alerts

Another great feature provided by many credit card issuers is the ability to set up account alerts. These can be set to notify you when you’re nearing your credit limit, if a large purchase is made, or even for every transaction, providing real-time updates on your spending. This is an excellent tool for keeping your budget in check, as you can take immediate action if you notice any discrepancies or if your spending starts to veer off course. Plus, it adds an extra layer of security, ensuring that you’re the first to know if any unauthorized transactions occur.

Autopay Recurring Monthly Bills

One of the best ways to manage your finances and ensure that you never miss a payment is to use your credit card for autopaying your recurring monthly bills. Whether it’s utilities, subscriptions, or your gym membership, setting them up to be automatically paid with your credit card means one less thing to worry about. Additionally, autopaying with your credit card can help you consistently earn rewards, cash back, or points on your regular expenses. However, always ensure you have enough funds in your bank account to cover these charges when your credit card bill comes due.

Use “Card Lock” for Impulse Control

Impulse spending can be a major budget breaker. Fortunately, many credit card providers now offer a “card lock” or “freeze” feature. This allows you to temporarily disable your card, making it unusable for purchases. If you find yourself in a situation where you’re tempted to make an unnecessary purchase, activating this feature can give you a moment to reconsider and avoid impulse spending. It serves as a practical barrier between you and potential budgetary mishaps, ensuring you stay on track with your financial goals.

Maximizing Credit Card Rewards for Budgeting

Types of Rewards & How They Work

You’ve probably heard of credit card rewards, but how do they work, and how can they help with budgeting? There are various types of rewards, and some cards have the best rewards deals, including the Chase Sapphire Preferred credit card for airline miles, Capital One credit cards for cash back, and the Venture Rewards card from Capital One for travel rewards. When you spend on your card, you earn points or cash back based on your spending.

For example, some cards offer cash-back rewards where you might earn 1% back on all your purchases. If you spend $500 in a month, you’d get $5 back. It might not seem like much, but it can add up over time. Other cards offer points for every dollar spent, which you can later redeem for airline tickets, hotel stays, or even gift cards.

Beneficial Credit Card Offers for Budgeting

Different cards come with different rewards and benefits, so it’s essential to find the one that aligns with your spending habits and budgeting goals. For travelers, a card that offers travel rewards or airline miles might be beneficial. If most of your expenses are everyday purchases like groceries or gas, then a cash-back card might serve you best.

Promotions like a “welcome offer” or bonus points in the first year can also be a way to boost your rewards early on. However, always be wary of annual fees. Some cards waive the fee for the first year, while others have them from the start. It’s essential to ensure that the rewards and benefits you gain from the card outweigh any associated costs.

Managing Multiple Cards for Maximum Benefits

It might be tempting to sign up for multiple cards to maximize rewards. While this can be a smart strategy, managing multiple cards requires careful attention. You’ll want to ensure you’re meeting the spending requirements for each card’s rewards, without overspending and ending up in debt.

To do this, consider dedicating specific expenses to specific cards. For instance, use one card exclusively for groceries and another for travel. Using a budgeting app can also help you keep track of your spending across different cards, ensuring you stay on track with your financial goals.

Risks & Tips: Responsible Credit Card Use

Understand the Risks of Misusing Credit Cards

While credit cards offer numerous benefits and conveniences, they aren’t without risks. The most evident risk is accruing credit card debt, especially if you’re trying to budget on a low income. When not paid off in full, the balance carries over to the next month, and interest is added, making it harder and more expensive to pay off over time. Consistently carrying a high balance relative to your credit limit can harm your credit score, affecting your ability to secure loans or other credit products in the future.

Avoid High Interest and Fees

To avoid high interest charges, always aim to pay off your full balance by the due date. If that isn’t possible, at least make the minimum payment to avoid late fees. Be aware of any annual fees associated with your card. As mentioned earlier, make sure the rewards and benefits you get from the card outweigh any fees. Lastly, if you’re considering balance transfers to a new card, be mindful of balance transfer fees and any introductory APR offers’ expiration dates.

Monitor Your Credit Utilization Ratio

Your credit utilization ratio, which is the amount of credit you’re using relative to your credit limit, plays a significant role in determining your credit score. A high ratio can indicate that you’re overly reliant on credit and pose a higher risk to lenders. To maintain a good credit score, it’s recommended to keep your credit utilization ratio below 30%. This means if you have a credit limit of $10,000, try to keep your balance below $3,000.

Be Wary of Too Many Cards

While it might be tempting to open multiple credit card accounts to maximize rewards or benefits, juggling too many cards can be a risk. Not only does it become challenging to manage multiple payment due dates, but each time you apply for a new credit card, it results in a hard inquiry on your credit report, which can temporarily decrease your credit score.

Regularly Check Your Credit Report

Regularly checking your credit reports from agencies like Experian or using apps that monitor your credit score can keep you informed about your financial health. It’s also a good practice to stay updated on the terms and conditions of your credit card, as these can change.

Frequently Asked Questions